Challenges abound in the business world due to global economic shifts, technological advancements, regulatory changes, or even competitive pressures. According to recent research, over 80% of executives acknowledge that strategic risks can significantly impact their organization's ability to achieve objectives.

This underscores the critical need for strategic risk management, a discipline aimed at proactively identifying, assessing, and addressing risks that could derail strategic goals.

This article provides a deep dive into strategic risk management, why it is important for organizations, how to assess strategic risks, best practices for implementing strategic risk management, and more.

Strategic risk management is a systematic process aimed at identifying, assessing, and mitigating risks that could potentially thwart an organization's strategic goals.

It goes beyond dealing with the here and now, focusing instead on long-term objectives and identifying external and internal threats that could derail these goals.

While operational risk management addresses the day-to-day hurdles a company might face, strategic risk management is all about looking at the bigger picture. It’s about understanding and mitigating risks that could fundamentally alter a company’s trajectory or even threaten its existence.

By examining real-world examples, we gain insights into the pivotal role of strategic risk management in securing a company's future. Let’s have a look at a few:

The Kodak Moment: The Peril of Ignoring Technological Advancement

One of the most illustrative examples of the failure to manage strategic risk comes from the downfall of Kodak, once a titan in the photography industry. Kodak's decline was not due to operational inefficiencies but stemmed from a monumental strategic oversight: the underestimation of digital photography's potential to disrupt the film market.

Kodak, despite inventing the first digital camera in 1975, chose to sideline the technology, fearing it would cannibalize its film business. This decision illustrates a critical strategic risk—failing to adapt to technological advancements.

The consequences of this miscalculation were profound. By the time Kodak acknowledged the shift in consumer preferences towards digital photography, competitors had already secured a stronghold in the market.

Kodak's hesitation to pivot and innovate led to a loss in market share, diminishing brand value, and eventually, bankruptcy in 2012.

It serves as a powerful testament to the importance of acknowledging and adapting to technological trends, underlining how strategic risk management is not just about sidestepping threats but also about ensuring organizational agility and resilience.

Blockbuster’s Brush-off of the Streaming Model

Another notable example of strategic risk mismanagement is Blockbuster’s decline with the rise of streaming services like Netflix.

In the late 2000s, Blockbuster was at the zenith of the video rental industry. However, it failed to foresee and adapt to the strategic risk posed by the internet and streaming technology. Netflix initially offered a mail-based rental service, which didn't directly threaten Blockbuster's instant gratification model.

However, Netflix's pivot to streaming represented a seismic shift in how media could be consumed — a strategic risk Blockbuster failed to acknowledge effectively. While Blockbuster did attempt to introduce an online service, it was too little, too late, and the company filed for bankruptcy in 2010.

Blockbuster's downfall illustrates the peril of overlooking strategic risks stemming from consumer behavior changes and technological innovation. The brand's focus on physical rentals and late fees, which once were its revenue staples, became its Achilles' heel.

As streaming technology reduced costs and increased convenience for consumers, Blockbuster’s value proposition weakened. This case emphasizes the importance of continuously monitoring the strategic landscape and being willing to change business models in response to emerging threats and opportunities.

A strategic risk management framework is a structured approach adopted by organizations to identify, assess, and manage risks that could potentially impact their strategic objectives and long-term success.

It encompasses processes, methodologies, and tools aimed at aligning risk management activities with the organization's strategic goals, enabling informed decision-making and enhancing resilience in the face of uncertainties.

Some of the most well-known strategic risk management frameworks are the COSO ERM framework, NIST RMF, and ISO 31000.

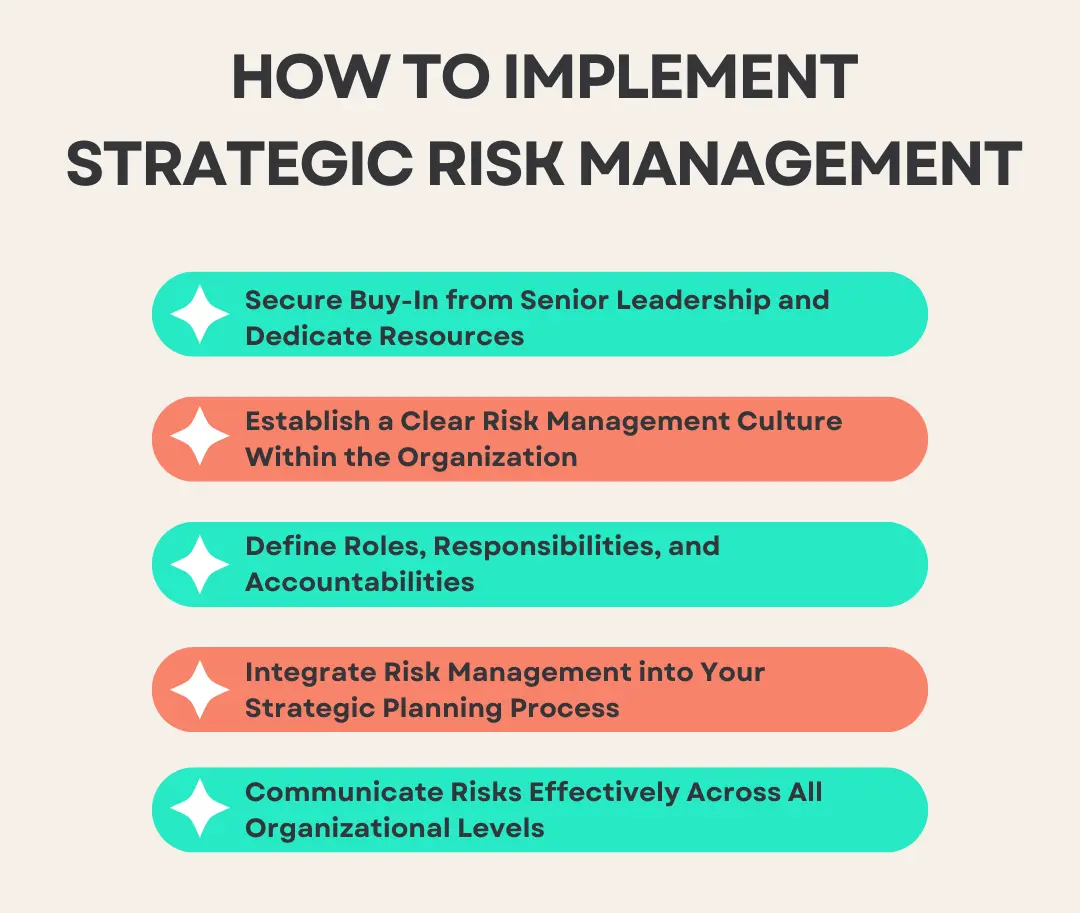

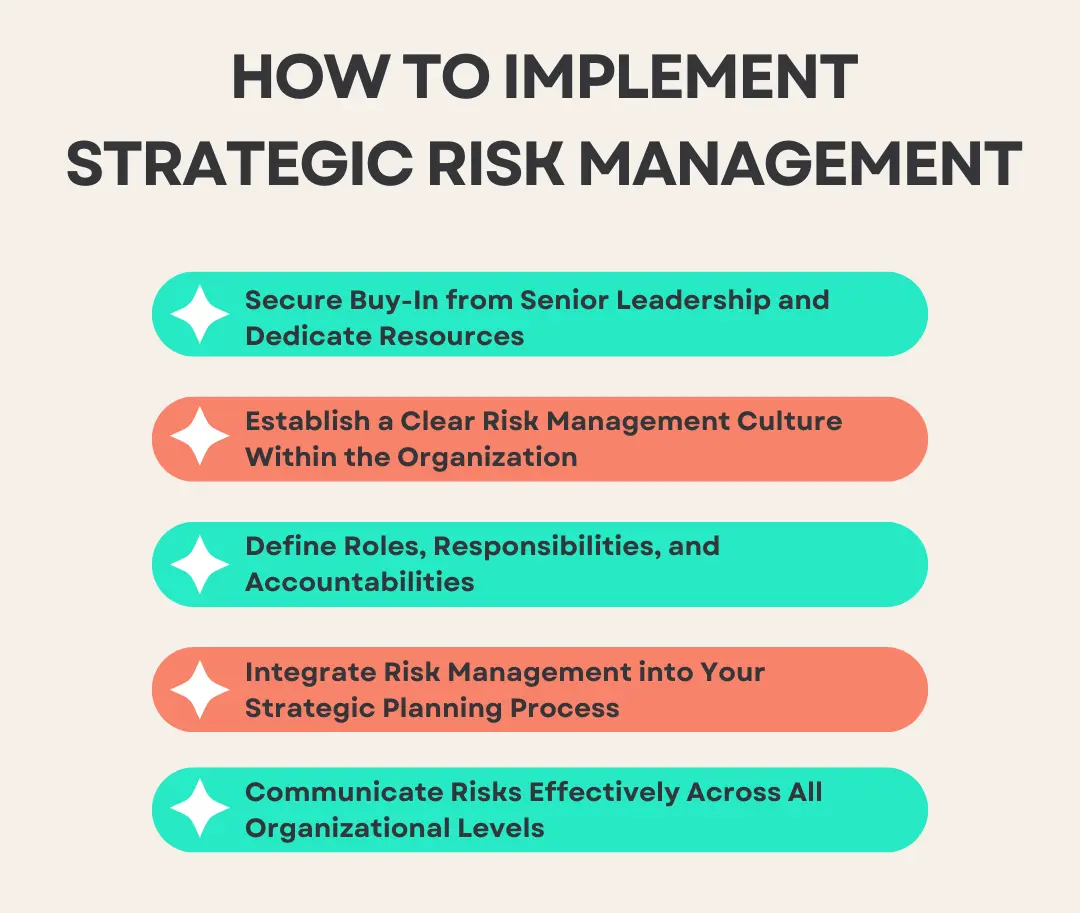

Here are actionable steps for organizations to implement strategic risk management:

Strategic risks are inherently different from operational or financial risks due to their impact on an organization's long-term goals, competitive advantage, and overall business strategy. Unlike operational risks, which typically involve day-to-day processes or systems, and financial risks, which focus on monetary aspects like investments or liquidity, strategic risks encompass broader considerations.

These risks are intricately tied to an organization's strategic decisions, market positioning, and ability to adapt to changing environments. There are two widely used key metrics that help measure strategic risk – economic capital and risk-adjusted return on capital (RAROC):

Strategic risk management is a pivotal element in a world characterized by volatility, uncertainty, complexity, and ambiguity. Its importance can be seen across various facets of an organization. This approach fosters agility, allowing businesses to adapt to emerging risks and seize opportunities.

By anticipating and mitigating setbacks, organizations build resilience and ensure operational continuity. Robust risk management practices also enhance investor confidence, signaling sustainability and growth potential, which can attract stable and increased investment.

Here are some of the top reasons why strategic risk management is important for businesses:

MetricStream Enterprise Risk Management software is a powerful solution that can help organizations streamline their strategic risk management processes. By offering an integrated risk management solution that covers risk identification, assessment, mitigation, and reporting, MetricStream simplifies these complex tasks and also ensures they are interlinked and feed into one another.

This interconnectedness is vital for organizations aiming to make strategic decisions that are informed, agile, and resilient in the face of uncertainties.

To learn more about MetricStream Enterprise Risk Management(ERM) , request a personalized demo today.